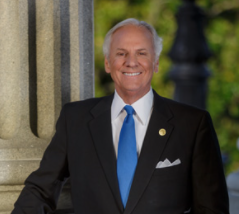

COLUMBIA, SC – The South Carolina Department of Veterans’ Affairs (SCDVA) joined South Carolina Governor Henry McMaster for the ceremonial signing of (H.3247) Workforce Enhancement and Military Recognition Act that officially became effective in May.

WATCH the full bill signing ceremony by clicking HERE.

The ceremonial bill signing on Wednesday, June 29 at the Shaw Sumter Welcome Center in Dalzell, SC, also comes the same day that SCDVA releases its 2022 study on the Economic Impact of South Carolina’s Military Community. The study was commissioned by SCDVA and prepared by Research Economist, Dr. Joseph C. Von Nessen at the University of South Carolina.

According to the report, the annual economic impact of the military community in South Carolina is $34.3 billion a 35% increase from 2019. This translates to 254,095 jobs that are supported (either directly or indirectly) by the military community along with $14.6 billion in labor income for South Carolinians.

The Palmetto State is home to eight major military installations and numerous other facilities throughout the state supporting 68,493 Department of Defense personnel, of all branches of Service and components. 69% of service members are active duty and 31% are Reserve Component (Guardsmen and Reservists). Importantly, this is the 10th highest density of service members in the nation. There are another 17,579 service members who serve just across the border at Fort Gordon, Georgia, with many living in South Carolina.

The release of the 2022 study on the Economic Impact of South Carolina’s Military Community comes just months after South Carolina Governor Henry McMaster signed the Workforce Enhancement and Military Recognition Act (H.3247), making the Palmetto State one of more than three dozen states that exempt military retiree-pay from taxation. The study supports Governor McMaster’s signing of the new law.

"Today is a monumental day for Veterans in South Carolina. This tax cut for those who have served our country has been a top priority of mine for over five years now,” said Governor Henry McMaster. "This important step adds to South Carolina's reputation as the most military friendly state in the country and further incentivizes our nation's Veterans to live, work and raise their families in South Carolina."

"Today is a monumental day for Veterans in South Carolina. This tax cut for those who have served our country has been a top priority of mine for over five years now,” said Governor Henry McMaster. "This important step adds to South Carolina's reputation as the most military friendly state in the country and further incentivizes our nation's Veterans to live, work and raise their families in South Carolina."

Military activities have a unique impact in that they attract and retain military retirees and transitioning service members according to the 2022 Economic Impact study. Retirees and many Veterans are able to use support facilities (e.g., medical care, commissary, recreational facilities) that the various military installations maintain, which makes them more likely to locate in South Carolina upon their retirement from active duty. The income retirees spend represents additional funding that supports local economic activity, according to the impact study.

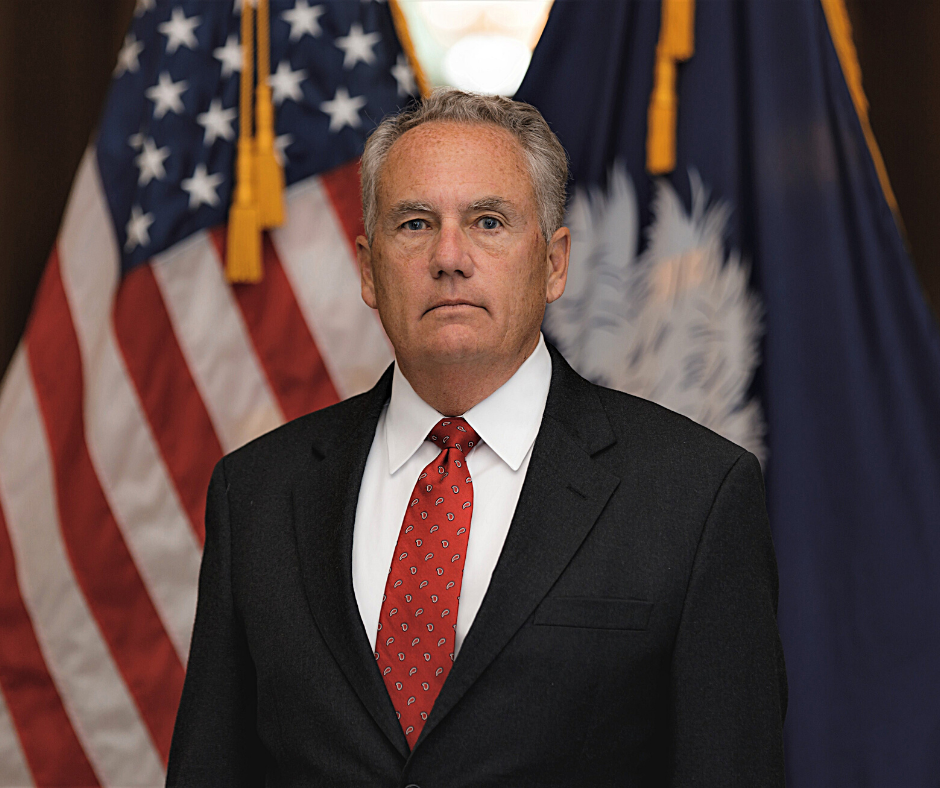

The 2022 study also finds there are 63,882 military retirees among the state’s 397,649 Veterans, making South Carolina the state with the 8th highest number of military retirees. South Carolina Department of Veterans’ Affairs Secretary Will Grimsley is a supporter of the Workforce Enhancement & Military Recognition Act (H.3247) and believes it will increase the overall number of Veterans who want to remain in our state once they retire.

“This important piece of legislation stands to have the most impact on our enlisted members, our non-commissioned officers. These men and women in uniform most directly contribute to South Carolina’s workforce, communities and service organizations,” says Secretary Grimsley. “No matter what branch of the military you served, non-commissioned officers are the backbone of our workforce and we want them to remain in South Carolina as contributing members to the vast number of employers seeking their skills and qualifications, and where their families to continue to live and thrive.”

“This important piece of legislation stands to have the most impact on our enlisted members, our non-commissioned officers. These men and women in uniform most directly contribute to South Carolina’s workforce, communities and service organizations,” says Secretary Grimsley. “No matter what branch of the military you served, non-commissioned officers are the backbone of our workforce and we want them to remain in South Carolina as contributing members to the vast number of employers seeking their skills and qualifications, and where their families to continue to live and thrive.”

The Workforce Enhancement & Military Recognition Act is effective beginning tax years after 2021 making military retiree pay 100-percent exempt from state income tax with no earned-income cap. Prior to the passage of the bill, a portion of a military retiree’s income was taxed with only partial exemptions in place.