COLUMBIA, SC (SCDVA & DFAS) - South Carolina military retirees can now take advantage of more money in their pocket thanks to a new law in our state.

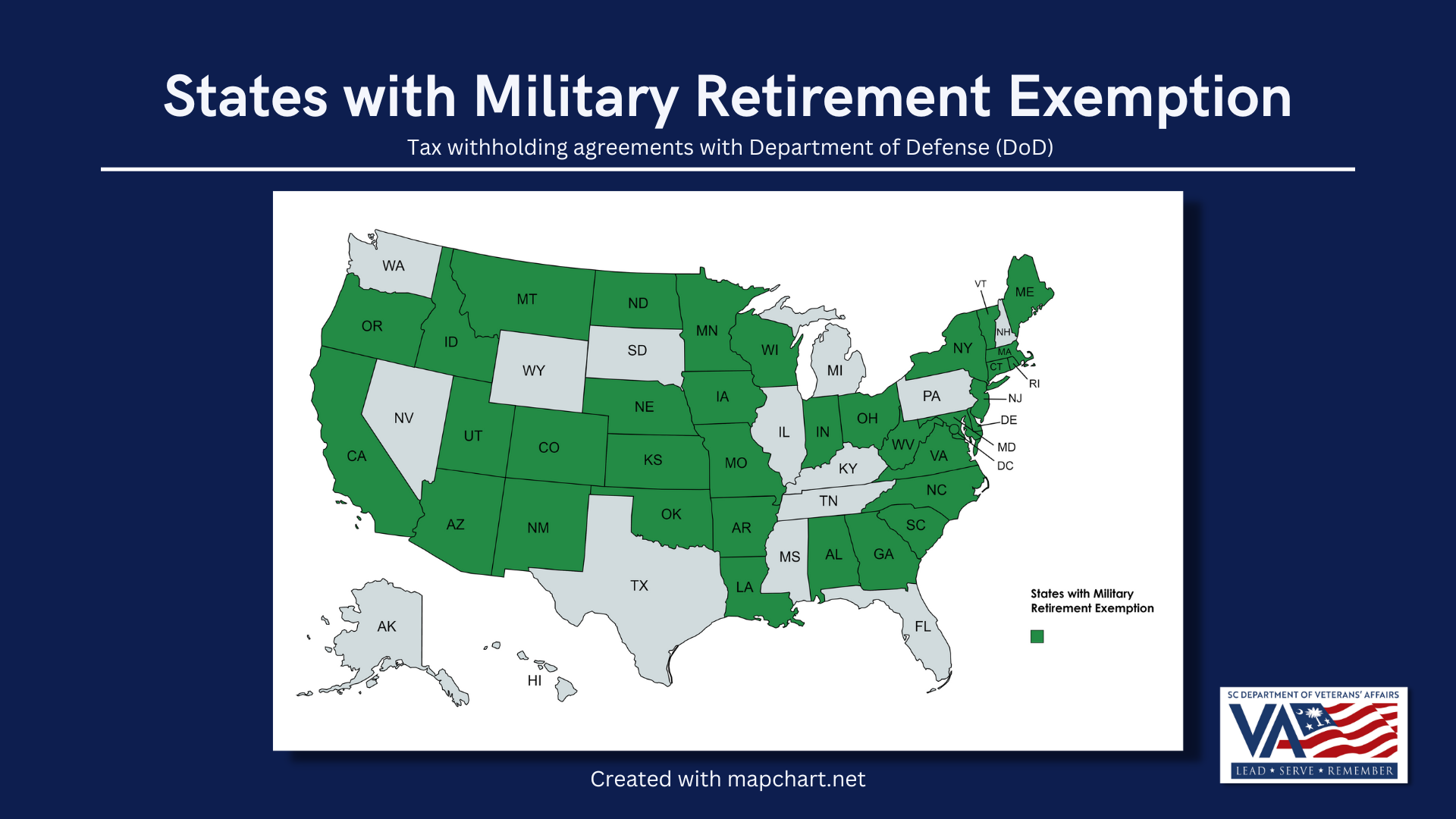

Earlier this year, South Carolina Governor Henry McMaster signed the Workforce Enhancement and Military Recognition Act. The law is effective beginning tax years after 2021 making military retiree pay 100-percent exempt from state income tax with no earned-income cap. South Carolina is now one of three dozen states to offer this incentive. We’ve received questions from military retirees about how to claim this incentive. Here’s what we’ve learned from the Defense Finance and Accounting Service (DFAS) below.

Earlier this year, South Carolina Governor Henry McMaster signed the Workforce Enhancement and Military Recognition Act. The law is effective beginning tax years after 2021 making military retiree pay 100-percent exempt from state income tax with no earned-income cap. South Carolina is now one of three dozen states to offer this incentive. We’ve received questions from military retirees about how to claim this incentive. Here’s what we’ve learned from the Defense Finance and Accounting Service (DFAS) below.

How to Start, Stop or Change State Income Tax Withholding from Your Military Retired Pay

Military retirees can start, stop or change state income tax withholding (SITW) by using myPay, by filling out and sending a DD Form 2866 Retiree Change of Address/State Tax Withholding Request, or by sending a written request that includes all of the necessary information.

DFAS can only withhold income tax for one state at a time and the designated state must have signed the standard written State Income Tax Withholding agreement with the Department of Defense (DoD). Because tax obligations vary from state to state, contact your state's department of revenue regarding taxability of your military retired pay. VISIT SCDOR website HERE.

Use myPay to Start, Stop or Change SITW

The easiest and most secure option to start, stop or change your state income tax withholding (SITW) is to use myPay.

Once you are logged in to your Military Retiree account, go to the far left column and click on “State Withholding.” Click on the green tab to add or change state withholding and enter an amount of at least $11. Click the “Continue” button, review the amount and then click the “Submit” button.

Use the DD Form 2866 or Send a Written Request to Start, Stop or Change SITW

Whether using the DD 2866 form or a written request, the request must indicate a whole-dollar amount greater than $10 and the state for which to withhold this amount For example, "I would like to have $11 withheld for Georgia State Income Tax Withholding." If you send a written request that is not on the form, please include your full name, daytime phone number, social security number and signature on all written correspondence. DFAS cannot process requests that do not include this information.

Mail or fax your request to:

Defense Finance and Accounting Service

U.S. Military Retirement Pay 8899 E 56th Street Indianapolis, IN 46249-1200

Fax to: 1-800-469-6559